When a life-saving medication has no generic version, the price can be staggering-sometimes over $10,000 a month. For many patients, that’s not just expensive-it’s impossible. But there’s a lifeline: Patient Assistance Programs (PAPs). These aren’t charity handouts. They’re formal, structured programs run by drug manufacturers, nonprofits, and sometimes state agencies to help people get the exact medication their doctor prescribed-even when there’s no cheaper alternative. The truth? If you’re paying full price for a brand-name drug with no generic, you’re likely overpaying by thousands. PAPs can cut that cost to $0. But getting there isn’t simple. Here’s how to actually make it work.

What PAPs Really Do (And What They Don’t)

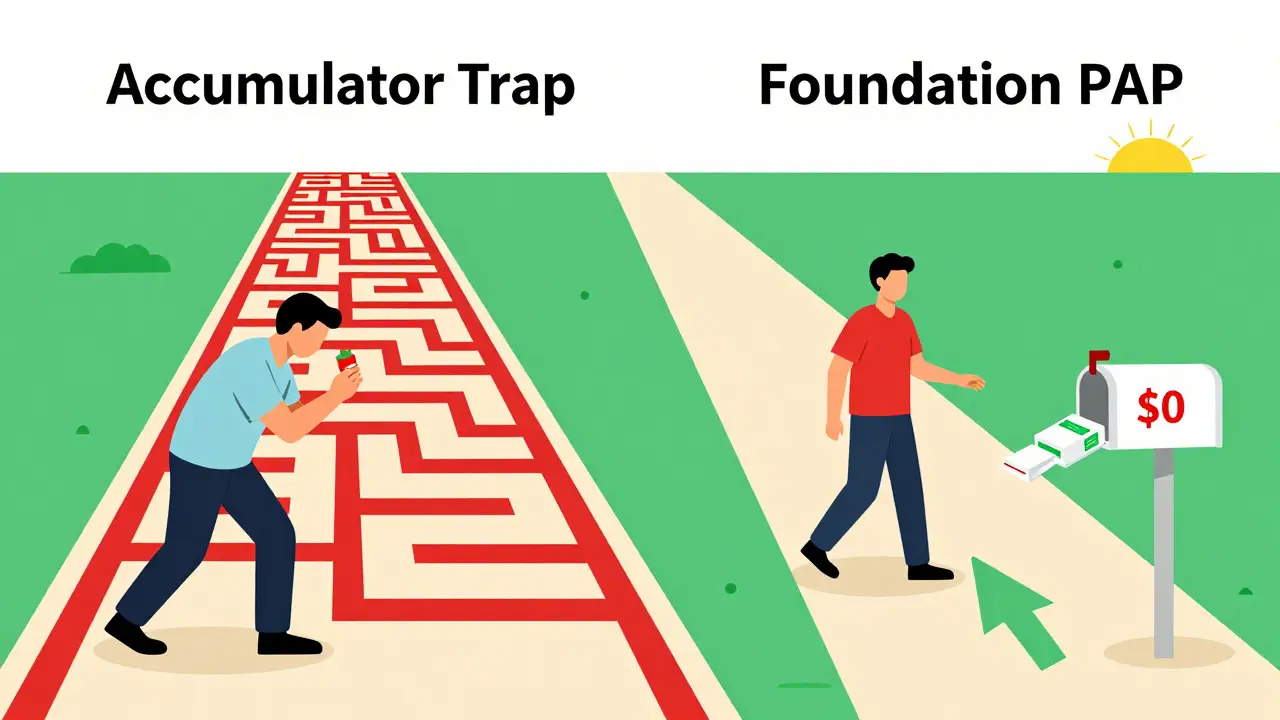

PAPs exist because drug companies set list prices so high that even insured patients can’t afford their copays. For drugs like Soliris, Tasigna, or certain HIV treatments, the monthly cost can hit $15,000 or more. No generic exists. No insurance plan fully covers it. That’s where PAPs step in. They don’t negotiate discounts like GoodRx. They cover 100% of the cost for eligible patients. In 2022, these programs distributed over $4.7 billion in free medication to 1.2 million people in the U.S.-mostly for brand-name drugs with no alternatives. But here’s the catch: PAPs aren’t magic. They don’t work for everyone. If you have Medicare Part D, federal rules block you from using manufacturer-sponsored copay help. If you have commercial insurance with an “accumulator adjustment” policy, your PAP assistance might not count toward your deductible. That means you could still owe thousands even after getting approved. Understanding these traps is half the battle.Who Qualifies? Income Isn’t the Only Factor

Most PAPs require proof you can’t afford the drug. That usually means income below 400% of the Federal Poverty Level. In 2023, that’s $60,000 for a single person. But some programs set the bar lower-at 200% or even 150%. You’ll need documents: recent tax returns, pay stubs, or a letter from a government agency showing you get SNAP, Medicaid, or SSI. If you’re uninsured, that’s easier. If you’re insured, you’ll need a letter from your insurer denying coverage or showing your copay is unaffordable. You also need a valid prescription. Not just any script-on official letterhead, signed by your doctor. Many programs require your doctor to fill out a form confirming the medication is medically necessary. Some even require a letter explaining why no generic is suitable. This isn’t bureaucracy for fun. It’s how they prevent fraud. But it’s also where most people get stuck.The Application Process: What You Actually Need to Do

Don’t start by calling the drug company. Use a free tool like RxHope or NeedyMeds. These sites let you search over 90% of manufacturer PAPs by drug name. Type in your medication. The site tells you which programs exist, what income limits apply, and what documents are required. It even links to the application forms. Once you pick a program, gather everything before you start filling out the form:- Proof of income (tax return, W-2, or pay stubs from the last 3 months)

- A copy of your prescription (on doctor’s letterhead)

- Insurance cards (even if you’re denied coverage)

- Your doctor’s completed attestation form (ask them early-this can take days)

- A copy of your denial letter if your insurer refused to cover the drug

The Role of Your Doctor and Care Team

Your doctor isn’t just prescribing the drug-they’re your key to getting it. Many clinics now have medication access specialists or patient navigators. These are staff members trained to handle PAPs. They know which forms to fill, who to call, and how to push through delays. Ask if your clinic has one. If not, ask your doctor’s office to help. They’re legally allowed to submit documents on your behalf. In fact, 85% of successful PAP applications are handled by clinic staff, not patients. Why? Because they’ve done this hundreds of times. They know how to get a signature from a busy doctor. They know which insurance denial letters are acceptable. They know which programs have faster processing times. If your clinic doesn’t have a navigator, call the nonprofit Patient Advocate Foundation. They offer free help over the phone. You don’t need to be poor. You don’t need to be uninsured. If you’re struggling to pay, they’ll walk you through it.

What Happens After You Apply

Approval times vary. Manufacturer programs (like those from Novartis or Gilead) usually respond in 7-10 business days. Foundation programs (like the Patient Access Network Foundation) take longer-14-21 days. Once approved, the drug company ships the medication directly to your pharmacy or home. No more copays. No more bills. But here’s the trap most people don’t see: accumulator adjustments. If you have commercial insurance, your PAP assistance might not count toward your deductible or out-of-pocket maximum. That means you’re still paying full price until you hit your annual cap. For example, if your deductible is $8,700 and your drug costs $12,000 a month, you could pay $20,700 out of pocket-even with PAP help. That’s not a mistake. It’s policy. Over 78% of major pharmacy benefit managers (PBMs) like Express Scripts and Optum do this. The fix? Switch to a foundation-sponsored PAP. These aren’t run by drug companies, so they’re not subject to accumulator rules. Programs like the Chronic Disease Fund or the HealthWell Foundation can cover your drug without triggering the deductible trap. But they’re harder to get into. They often have waiting lists. You’ll need to reapply.What to Do If You’re on Medicare

If you’re on Medicare Part D, you can’t use manufacturer PAPs at all. That’s federal law. But you’re not out of options. Foundation PAPs still work. The Patient Advocate Foundation, the Leukemia & Lymphoma Society, and others offer assistance specifically for Medicare beneficiaries. You’ll need to prove your income is below 400% FPL. You’ll still need a prescription. But the process is similar. Also, check if your state has a pharmaceutical assistance program. States like Pennsylvania (PACE) and New York (EPAP) help seniors with drug costs. These programs often have higher income limits than federal PAPs and aren’t affected by accumulator rules.Real Stories: Success and Struggle

One patient in Florida was paying $14,000 a month for Tasigna, a leukemia drug with no generic. Her insurance covered $1,400. She owed $12,600. She applied to Novartis’s PAP. Got approved. Her monthly cost dropped to $0. She kept her job. She kept her home. Another patient in Ohio had the same drug. She was insured. Her PAP was approved-but her insurer refused to count the assistance toward her deductible. She ended up paying $20,700 out of pocket before hitting her max. She had to borrow money from family. She missed work. She nearly quit treatment. The difference? One used a manufacturer PAP. The other didn’t realize her plan had an accumulator clause. The second patient later switched to a foundation PAP and got relief. But she lost three months of treatment.

Why This System Is Broken (And What’s Changing)

PAPs are a band-aid on a bullet wound. Drug companies set prices so high that they need PAPs to make their drugs affordable. That’s the irony. The more expensive the drug, the more PAPs are needed. And the more PAPs are used, the more companies can justify raising prices. But change is coming. In 2023, Eli Lilly launched a program called “Simple Bridge” that cut their insulin PAP application from 17 steps to 5. Approval now takes 48 hours. Epic Systems, the giant EHR company, is integrating PAP eligibility checks directly into doctors’ electronic records. By 2024, a doctor will be able to see if a patient qualifies for a PAP before even writing the prescription. The goal? Make this easier. Less paperwork. Less delay. Less chance of someone dropping treatment because they couldn’t fill out a form.What You Can Do Today

If you’re paying full price for a brand-name drug with no generic:- Go to RxHope.com and search your drug.

- Print the eligibility requirements and gather documents.

- Call your doctor’s office and ask if they have a medication access specialist.

- If not, call the Patient Advocate Foundation at 1-800-532-5274.

- Don’t wait. Processing times add up. Start now.

Frequently Asked Questions

Can I use a Patient Assistance Program if I have insurance?

Yes, you can. Many PAPs accept patients with insurance, especially if your copay is high or your plan doesn’t cover the drug. But if your insurer uses an accumulator adjustment policy, the PAP assistance won’t count toward your deductible or out-of-pocket maximum. This can leave you paying thousands even after approval. Ask your insurer if they have accumulator rules. If they do, consider switching to a foundation-sponsored PAP, which isn’t affected by these policies.

Do I need to be uninsured to qualify for a PAP?

No. Uninsured patients are the most common users, but many programs help people with insurance too. The key is whether you can afford your out-of-pocket costs. Most programs require your income to be below 400% of the Federal Poverty Level ($60,000 for one person in 2023), regardless of insurance status. If your copay is $1,000 a month and you make $50,000 a year, you likely qualify.

How long does it take to get approved for a PAP?

Manufacturer-sponsored programs usually approve applications in 7-10 business days. Foundation-sponsored programs take longer-14-21 days-because they review more documents. If your application is incomplete or missing a signature, it can be delayed by weeks. Start early. Don’t wait until your prescription runs out. Have your doctor’s office help you. They’re experienced and can cut processing time in half.

Can Medicare beneficiaries use PAPs?

Medicare Part D beneficiaries cannot use manufacturer-sponsored copay assistance programs. This is a federal rule. But they can still apply for assistance from nonprofit foundations like the Patient Advocate Foundation or the HealthWell Foundation. These programs are not run by drug companies and are not subject to the same restrictions. Income limits still apply, and you’ll need proof of prescription and Medicare enrollment.

What if my PAP application is denied?

Don’t give up. About 41% of initial applications are denied-but most are denied for simple reasons like missing documents or outdated income proof. Call the program directly. Ask what’s missing. Fix it. Resubmit. You can also appeal. The Patient Advocate Foundation offers free appeal help. Some programs even allow you to reapply if your financial situation changes. Persistence pays off.

Are there alternatives to PAPs if I can’t get approved?

Yes. Pharmacy discount cards like GoodRx can help, but they offer little to no savings on brand-name drugs with no generic-often less than 10% off. State pharmaceutical assistance programs (SPAPs) like Pennsylvania’s PACE may offer more reliable help for seniors. Nonprofit organizations like the Chronic Disease Fund or the American Cancer Society sometimes offer grants for medication costs. And if you’re eligible for Medicaid, enrolling can eliminate out-of-pocket costs entirely. Don’t rely on one option. Try multiple paths.

Meenal Khurana February 4, 2026

Just applied for my mom’s drug through RxHope. Took 45 minutes. Got approved in 8 days. Zero copay now.

Don’t overthink it. Just start.

Joy Johnston February 4, 2026

As a former patient navigator at a large hospital system, I can confirm: 85% of successful PAP applications are handled by clinic staff-not patients.

Doctors who don’t have access specialists in their office are doing their patients a disservice. It’s not just about prescribing-it’s about facilitating access.

Many clinics now have dedicated roles for this. If yours doesn’t, ask for one. It’s a legitimate operational gap.

Also, accumulator adjustments are a scam disguised as policy. PBMs profit when patients hit their deductibles. That’s not healthcare. It’s revenue optimization.

Shelby Price February 6, 2026

huh. so like… i had no idea this existed?

my friend’s on Soliris and she’s been paying $12k/month…

wait, so you can just… get it for free? 😮

Keith Harris February 6, 2026

Oh wow, another feel-good sob story about pharma being ‘evil.’

Let me guess-you’re also mad that insulin costs $300 instead of $3?

Here’s the truth: PAPs exist because drug companies are forced to price-gouge just to fund R&D. You think cures grow on trees?

And let’s not pretend ‘foundations’ aren’t just middlemen siphoning donations while patients wait 3 weeks for pills.

Also, ‘accumulator adjustments’? That’s not a trap-it’s how insurance works. You don’t get to have your cake and eat it too.

Stop romanticizing bureaucracy. Fix the system, not the symptoms.

Mandy Vodak-Marotta February 8, 2026

Okay, so I’ve been helping my cousin through this whole process and honestly? It’s a full-time job.

Like, I had to call her doctor three times to get the attestation form signed. The first time they said ‘we don’t do that.’ The second time they said ‘send us a template.’ The third time, I showed up in person with coffee and a printed form.

And then the insurance denial letter? They sent the wrong version. Had to re-request it. Took 11 days.

And then the PAP portal crashed on submission. Twice.

And now we’re waiting for the foundation to process it because her plan has the accumulator clause.

I’m not even mad. I’m just… exhausted.

Why does this have to be this hard? Like, if someone’s on a $15k/month drug, shouldn’t someone-anyone-just make this easier?

I’m not a lawyer. I’m not a nurse. I’m just a cousin who knows how to use Google and has too much free time.

Harriot Rockey February 9, 2026

This made me cry 😭

My sister was on Tasigna too. We thought we were alone.

She applied through NeedyMeds, got approved in 6 days, and now her meds come in the mail like a gift. No bills. No stress. Just… life.

And you know what? Her doctor didn’t even know about the foundation options until I showed her the article.

So please-share this. Tag someone who needs it. Send it to your local rep. This isn’t charity. It’s justice.

You are worthy of healing. No matter your income. No matter your insurance. You deserve to live.

rahulkumar maurya February 9, 2026

How quaint. A guide for Americans who can’t handle capitalism.

Let’s be honest: if you can’t afford a $10,000/month drug, perhaps you shouldn’t be taking it.

There are generics for 98% of medications. If yours isn’t one, maybe your diagnosis is overblown.

And let’s not pretend these PAPs aren’t just PR stunts by Big Pharma to avoid regulation.

Why not just nationalize drug pricing? Oh right-because you’d rather beg for scraps than demand systemic change.

Pathetic.

Alec Stewart Stewart February 10, 2026

I just want to say thank you to whoever wrote this.

I’m not a patient. I’m a caregiver. My dad’s on a drug with no generic. We thought we were stuck.

This guide? It saved us.

We called Patient Advocate Foundation last week. They walked us through every step. No judgment. No red tape. Just help.

He got his meds last Tuesday.

He’s sleeping through the night now.

You don’t need to be rich to deserve care.

You just need someone to tell you it’s possible.