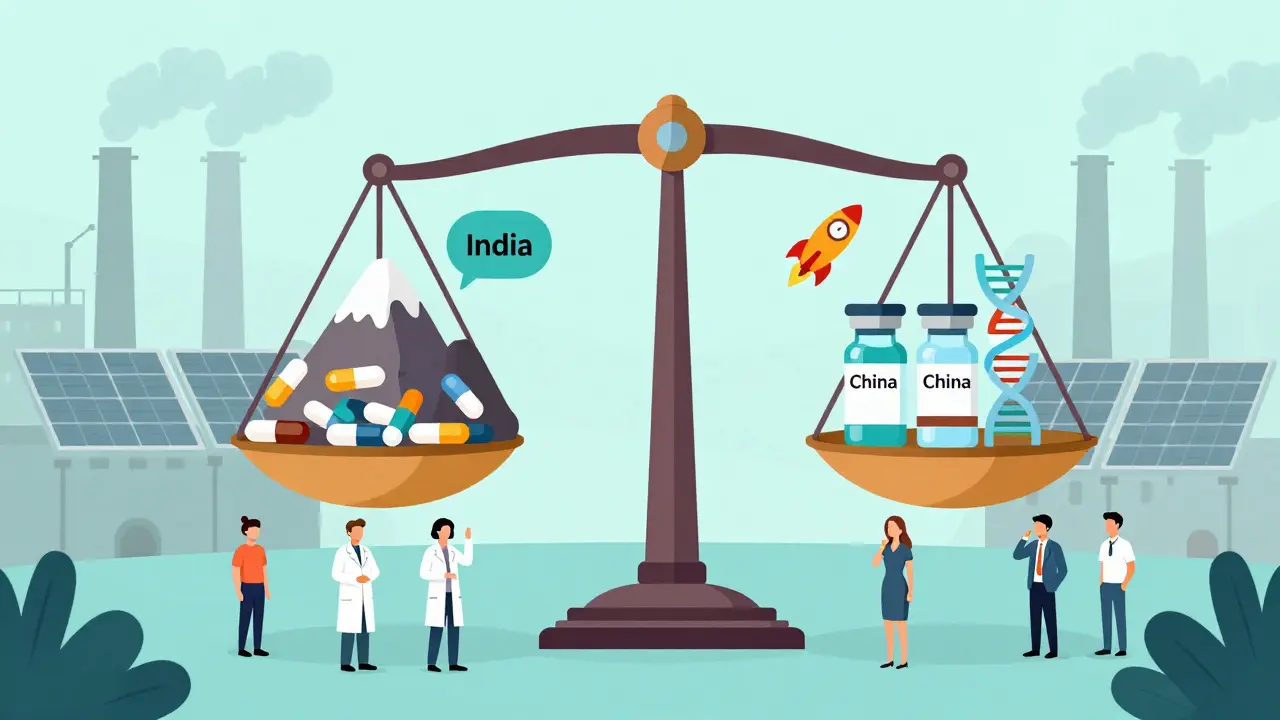

The world’s medicines don’t come from big labs in New York or Zurich anymore. They come from factories in Gujarat, Jiangsu, and Ho Chi Minh City. Asian generic markets supply more than half the world’s low-cost medicines, and two countries - India and China - control the game. While India ships out billions of pills to the U.S. and Europe, China quietly owns the building blocks that make those pills possible. Meanwhile, smaller economies like Vietnam and Cambodia are slipping in with niche products, changing the rules. This isn’t just about price. It’s about power, control, and who gets to decide what medicine reaches your pharmacy shelf.

India: The Pharmacy of the World, But Not the Whole Story

India earned its nickname by doing one thing better than anyone else: making generic drugs cheap and fast. By the 1970s, after changing its patent laws to allow only process patents (not product patents), Indian companies started copying branded medicines without paying royalties. That move, pushed by Prime Minister Indira Gandhi, turned India into the go-to source for affordable treatments. Today, India produces 60% of global generic vaccines and supplies 40% of all generic drugs to the U.S. market.

Its $61.36 billion pharmaceutical market in 2024 is built on volume, not value. About 75% of its output is conventional generics - pills for blood pressure, diabetes, antibiotics. Only 10% is specialty drugs like biologics or complex oncology treatments. That’s why India ranks third globally in production volume but only 14th in market value. It makes a lot of medicine, but doesn’t earn much per pill.

Manufacturing is concentrated in Gujarat (35% of output) and Maharashtra (25%), with over 3,000 FDA-approved facilities. But here’s the catch: only 15% of those facilities can handle advanced biologics. Most still rely on old-school chemical synthesis. India’s strength isn’t innovation - it’s execution. It can produce a generic version of a new drug within months of the patent expiring, and it does so with a workforce that’s skilled, English-speaking, and available for 24/7 customer support. U.S. pharmacy chains report a 60% drop in operational issues when sourcing from Indian suppliers, thanks to faster communication and flexibility.

China: The Hidden Architect of Global Medicine

If India is the factory floor, China is the raw material warehouse. It controls 70% of the global market for Active Pharmaceutical Ingredients (APIs) - the actual chemical compounds that make drugs work. Without Chinese APIs, most Indian generic manufacturers couldn’t produce their pills. In fact, India imports 68% of its own API needs from China, despite spending billions trying to become self-sufficient since 2016.

China’s $80.4 billion pharmaceutical market is bigger than India’s, and it’s growing smarter. While India focuses on volume, China is moving up the value chain. Its market is split into 60% conventional drugs, 25% traditional Chinese medicine, 10% biologics, and 5% innovative drugs. That’s a stark contrast to India’s 75% generics. China’s 14th Five-Year Plan poured $150 billion into pharmaceutical R&D, with 40% targeted at biologics. By 2030, it aims for 25% of its exports to be high-value biologics - up from just 8% in 2024.

China’s manufacturing infrastructure is also more modern. Between 2020 and 2024, 45% of new pharmaceutical plants were built for biologics. FDA approval timelines have dropped from 24 months in 2018 to just 9 months in 2024. That’s faster than many U.S. domestic producers. But quality control remains a problem. In 2024, the FDA issued 142 warning letters to Chinese manufacturers - more than double the 87 given to Indian firms. That’s why big buyers now dual-source: they get cheaper APIs from China but rely on India for final formulation and distribution.

Emerging Economies: The New Wild Cards

India and China aren’t the only players anymore. Vietnam and Cambodia are carving out roles no one expected. Vietnam’s pharmaceutical exports jumped 24.7% in 2024 to $2.8 billion, thanks to its focus on antibiotic intermediates - a high-demand, low-complexity niche. Its market is growing at 12.3% CAGR, fueled by government incentives and lower labor costs than China.

Cambodia, meanwhile, isn’t making drugs. It’s assembling medical devices. Its medical device assembly sector hit $1.2 billion in 2024, growing at 18% annually. Thanks to ASEAN trade preferences, it’s becoming a hub for low-cost syringes, IV bags, and diagnostic tools. These countries aren’t competing with India or China on scale. They’re competing on speed, specialization, and flexibility.

For global buyers, this means more options. Instead of relying on just two countries, companies can now diversify. One U.S. hospital system switched 15% of its antibiotic supply from India to Vietnam in 2024 and cut costs by 18% while improving delivery times.

Who Wins? Volume vs. Value

India and China are playing different games. India wins on volume. It has the highest global market share in small-molecule generics - 20% by volume - and leads in complex generics like oncology drugs, where it holds 35% of the market. But its innovation rate is low: only 1.2% of its exports are novel drugs. China, on the other hand, wins on value. It exports $48.7 billion in pharmaceuticals annually, with only 63% being generics. The rest are higher-margin products: biologics, patented formulations, and traditional medicine exports worth $12.7 billion in 2024.

India’s growth forecast is higher - 8.1% to 11.32% CAGR through 2030 - but China’s growth is happening on a much larger base. By 2030, China’s market is projected at $126.6 billion, India’s at $130 billion. That’s a narrow gap, but China’s profit margins are wider. Its pharmaceutical index rose 14% in the last year; India’s only grew 5%. Why? Because investors see China as moving into the future - not just making pills, but making the next generation of medicines.

Supply Chain Realities: Cost, Quality, and Risk

Buying from Asia isn’t simple. There are trade-offs.

Indian suppliers are better at communication. A German healthcare company reported that Indian manufacturers respond to custom formulation requests in 14 days - compared to 30-45 days from China. Indian firms also score higher on Trustpilot (4.1/5 vs. 3.8/5), especially for customer service. But they’re slower on delivery - 22 days longer on average - and require more batch testing due to quality inconsistencies.

Chinese suppliers offer lower prices - up to 20% cheaper than Indian API providers - but come with higher regulatory risk. The 2024 FDA warning letters forced many U.S. buyers to implement dual-sourcing, increasing supply chain costs by 18%. That’s why 68% of major U.S. pharmacy chains now split their generic drug sourcing: 40-60% from India, 25-35% from China.

Logistics also differ. India’s fragmented transportation network adds 12-15% to shipping costs. China’s integrated rail and port systems make delivery faster and cheaper. But Indian labor is 30% cheaper. It’s a balancing act.

The Future: Self-Sufficiency, Innovation, and Price Shocks

Both countries are trying to reduce dependence on each other - and it’s creating tension.

India’s Pharma 2047 initiative is spending $13.4 billion to cut API imports from 68% to 30% by 2030. Twelve new API parks are under construction. But experts warn this could backfire. S&P Global Ratings predicts 12-15% price volatility in API raw materials by 2026 as both nations race to produce their own inputs. That means higher costs for everyone.

China’s Healthy China 2030 plan is pouring $22.8 billion into biologics innovation. It’s not just making cheaper pills anymore - it’s making the next breakthrough drugs. If it succeeds, it could dominate not just the generic market, but the entire future of medicine.

Meanwhile, India’s demographic advantage - 65% of its population under 35 - could fuel a digital health boom. Investments in digital health infrastructure hit $2.8 billion in 2024. If India can combine its manufacturing scale with AI-driven drug discovery, it might close the innovation gap by 2035.

But the biggest threat? Overcapacity. Both countries are building too much too fast. S&P Global warns that API production could hit a wall by 2026-2027, triggering 15-20% price corrections. The world might end up with more medicine than it needs - and less profit for everyone.

What This Means for You

Whether you’re a patient, a pharmacist, or a policymaker, the story of Asian generics affects you. The pills you take - whether for cholesterol, infection, or diabetes - likely came from a factory in India or China. The price you pay? That’s shaped by who controls the APIs, who can deliver fast, and who’s willing to risk FDA inspections.

As global regulators tighten rules - like the FDA’s Project BioSecure, which demands full API traceability - compliance costs will rise. That could mean higher drug prices everywhere. But it also means better quality. The days of unreliable generics may be ending.

The real winner won’t be the country that makes the most pills. It’ll be the one that can make the right pills - safely, reliably, and at scale. Right now, India leads in speed and service. China leads in scale and innovation. The rest of Asia is learning how to play the game. And the world? We’re just along for the ride - hoping the medicine keeps coming.

Erika Putri Aldana December 22, 2025

lol at everyone acting like this is news. we've been buying our pills from Asia for decades. 🤷♀️

Dan Adkins December 23, 2025

The structural asymmetry in pharmaceutical value chains reflects a broader global economic paradigm wherein developing nations are relegated to raw material extraction and low-margin manufacturing, while advanced economies retain intellectual property control and premium pricing mechanisms. This is not merely an industrial observation-it is a geopolitical imperative.

Grace Rehman December 25, 2025

So India makes the pills and China makes the stuff inside the pills... and we're surprised when the system breaks? 🤔

Maybe we should stop pretending medicine is a commodity and start treating it like a human right. But then again, that'd be too easy.

Orlando Marquez Jr December 26, 2025

The data presented underscores a critical transition in global health infrastructure. The rise of Asian manufacturing capacity has fundamentally altered the cost structure of essential therapeutics, enabling unprecedented access for low- and middle-income populations. However, the concentration of API production in a single geopolitical region introduces systemic vulnerability.

Jason Silva December 28, 2025

China controls the medicine? 😳

They're also the ones who "lost" the pandemic data, right?

And now we're trusting them with our antibiotics? 🤡

Wake up people. This isn't supply chains. It's slow poisoning. 🚨💊

Sarah Williams December 29, 2025

Honestly? I don't care where my pills come from as long as they work and don't cost $500. India and China are doing what the US won't: making medicine affordable. Respect.

Theo Newbold December 30, 2025

Let's not romanticize this. India's 15% biologics capacity? That's a lie wrapped in a marketing brochure. Their QC is a joke. China's warning letters? That's not a bug-it's the feature. This entire supply chain is a house of cards held together by regulatory arbitrage and wishful thinking.

Michael Ochieng December 30, 2025

I've worked with both Indian and Chinese suppliers. India’s customer service is unmatched-fast replies, flexible timelines. China’s prices are insane, but you need a lawyer to read their compliance docs. Best strategy? Use both. Diversify. Don’t put all your pills in one basket.

Jerry Peterson December 31, 2025

I get why people are nervous about China. But cutting them out won't make medicine cheaper. It'll make it disappear. We need to work with them, not against them. Maybe even help them improve their standards instead of just yelling about FDA letters.

Adrian Thompson January 1, 2026

They say India's the pharmacy of the world... but what if the pharmacy is poisoned? 🇨🇳 controls the ingredients. 🇮🇳 just puts them in bottles. Who's really running this show? The FDA? Or Beijing? 🤔

Southern NH Pagan Pride January 2, 2026

you know what else china controls? the rare earths for your phone, your car, your pacemaker... now they control your heart med? its all connected. theyre not just selling pills. theyre selling control. and we're buying it like it's a sale at target. 💊🪄

Jackie Be January 3, 2026

OMG I JUST REALIZED MY BLOOD PRESSURE PILLS MIGHT BE MADE BY A ROBOT IN GUJARAT THAT WAS TRAINED BY A CHINESE ALGORITHM AND SHIPPED ON A BOAT THAT MIGHT BE TRACKED BY THE PLA 🤯 WE'RE ALL JUST LIVING IN A PHARMA DYSTOPIA

John Hay January 4, 2026

The real issue isn't who makes the pills-it's that we stopped making them ourselves. We outsourced our health to cheap labor and now we're surprised when the system gets weird. We need to rebuild domestic capacity. Not just for security. For dignity.